The semiconductor industry is experiencing a period of rapid growth, with demand accelerating so much in 2020 it is now outpacing supply and causing global shortages.

Semiconductor manufacturers are ramping up plans to expand their production capacity to meet the demand, which is set to continue rising over the long term.

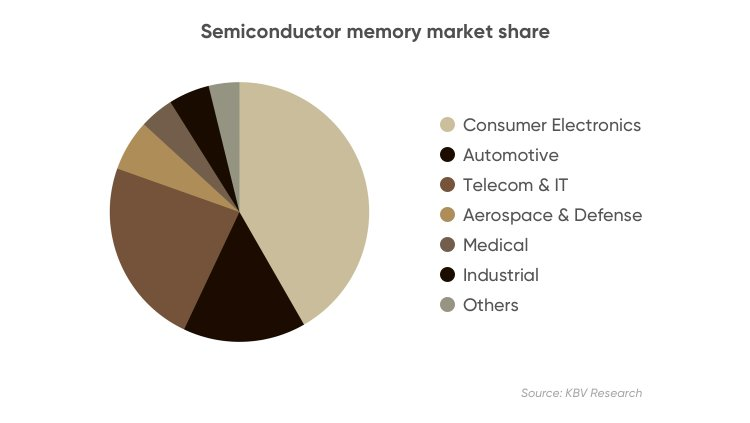

Sales of consumer electronics increased during the Covid-19 pandemic, and the adoption of 5G and smart devices is set to grow in the coming years. Online gaming, cloud computing and increased bandwidth on 5G networks is driving a spike in data-centre capacity. And the roll-out of electric vehicles (EV), with a jump in production after pandemic-related shutdowns in the first half of last year, is prompting vehicle manufacturers to compete for semiconductor supply.

The critical shortage has caused most of the major car manufacturers to temporarily close plants in recent months, and now the likes of Apple (AAPL) are also seeing disruptions. Governments in South Korea, Taiwan and China have pledged investment to increase production capacity, and on April 12, the Biden administration in the US convened a virtual meeting of technology and automotive executives to address how to build domestic capacity.

What does all this mean for the companies operating within the industry? Are semiconductor stocks a good investment?

Capital.com has looked at the top three semiconductor stocks to watch in 2021 so you can add them to your portfolio.

Best semiconductor stocks for 2021: 3 ways to profit from the global chip shortage

The VanEck Vectors Semiconductor ETF gained 53.5% in 2020 and has risen by another 15.7% year-to-date. If you are looking to pick individual companies to gain exposure to the sector, here are the top three semiconductor companies to invest in this year.

AMD

Shares in Advanced Micro Devices (AMD) hit an all-time intraday high of $99.23 in January, after rising by 115% from the start of 2020. The company has taken a substantial share of the PC and server processor markets previously dominated by Intel, and has introduced new chip technologies well in advance of Intel, which is experiencing ongoing delays.

Recommending it as one of the best semiconductor stocks to buy in 2021, analysts at Raymond James wrote in a recent note to clients: ※We expect AMD to maintain a sizable performance# advantage for some time.§

AMD reported a 45% year-on-year increase in revenue in 2020 to $9.76bn and expects revenue to rise by another 37% in 2021, driven by growth in all of its businesses. The company′s shareholders on April 7 approved its proposed $35bn acquisition of Xilinx, aimed at strengthening its data-centre offering. The deal is expected to close by the end of 2021.

AMD′s share price has fallen since its January high, reflecting the broader sell-off in technology stocks. The stock, which trades on the NASDAQ under the ticker AMD, dropped to an eight-month low of $73.96 per share in March, although it has since moved back to the $80 level.

Analysts expect the stock to continue to rebound as the company advances its high-growth strategy with new high-performance processors, gaming graphics cards and cloud partnerships. The average 12-month price target from 31 analysts covering the stock is $90.77, according to MarketBeat.

TSMC

Taiwan Semiconductor Manufacturing Company (TSMC) is the world′s largest semiconductor foundry, supplying the world′s major electronics firms 每 including Apple's new M1 chip as well as Intel, with which TSMC also competes. The company reported its third straight quarter of record sales for the first quarter. TSMC is well-positioned to take advantage of the growth in semiconductor demand and it plans to invest $100bn over the next three years to expand capacity.

The stock, which trades under the ticker TSM on the New York Stock Exchange (NYSE), reached an all-time intraday high of $142.20 per share in February. That was up by 143% from the start of 2020. It slipped back to the $108 level in March, but has since moved back above $120 per share.

Analysts at JP Morgan have an overweight rating on the stock and expect the company to issue guidance of 3% to 5% quarterly growth for the second quarter when it reports its January-March results on 15 April.

The analysts said: ※We continue to see upside surprise to 2021 revenue growth expectations (JP Morgan at 12% USD revenue growth versus company guidance of mid-teens) and forecast capex to come in at the high end of the guidance range ($28bn).§

※We expect TSMC to retain share at its key customers 每 Apple, Mediatek, Broadcom and AMD, while also gaining some share at QCOM and potentially NVDA in the 2022-23 timeframe. Intel share gains should also kick in from 2023 onwards.§

Nvidia

Shares in US-based Nvidia closed at a fresh record high of $627.18 on April 13, after 14 analysts upgraded their price targets at the start of the company′s week-long developers conference. On the first day, April 12, Nvidia introduced a new data-centre processor using technology from UK semiconductor and software developer ARM, which it announced plans to acquire in September 2020. The processor is designed to compete with offerings from Intel (INTC) and AMD. The company also announced that it expects to report first-quarter revenue above the $5.3bn guidance it issued in February.

※Overall demand remains very strong and continues to exceed supply, while our channel inventories remain quite lean,§ said Colette Kress, Nvidia′s executive vice-president and chief financial officer. "We expect demand to continue to exceed supply for much of this year. We believe we will have sufficient supply to support sequential growth beyond Q1.§

Nvidia trades on the NASDAQ under the ticker NVDA. The share price gained 120.5% in 2020 and has gained another 20.1% so far in 2021, making it one of the best-performing semiconductor stocks.

Following the analyst upgrade, the average price target has risen to $654.47 per share, up from a previous average of $642.85 per share, according to FactSet data. Analysts at Rosenblatt Securities are especially bullish on the stock, raising their price target to $800 per share, from $700 previously.

What the future holds: semiconductor shortage to linger into 2022

The semiconductor industry expects supply to remain tight into next year as there is a lead time of three to four months in chip production, and it takes around a year to add new capacity. In the meantime, the rise in demand is set to continue with the trends in 5G, gaming and electric vehicles starting a new cycle in the technology industry.

Analysts at Raymond James are bullish on the sector, although they are of the view that ※intervention by the US government could 每 as government intervention often does 每 drive inefficient behaviour which will lead to problems down the line# The other policy initiative 每 increasing semiconductor manufacturing in the US 每 is in our opinion a more worthy goal§.

The analysts note that TSMC is the world′s only source of leading-edge devices, having leapfrogged its competitors in developing technology: ※Should the world lose access to TSMC′s output, which is located solely in Taiwan and mainland China, it would have a devastating effect on the global economy.§

TSMC has committed to building two fabrication plants in the US in Arizona for lagging-edge, or older, devices. The analysts added: ※Based on Intel′s foundry initiatives as well as the growing geopolitical risks, we simply think it′s inevitable for TSMC to change that commitment to include leading-edge technology# we think TSMC′s customers will insist upon it. ※

Are you looking for the best way to invest in the semiconductor space? You can buy shares in individual company stocks, or buy a sector ETF to gain diversified exposure.

Alternatively, you can trade shares with contracts for difference (CFDs) at Capital.com. CFDs are trading instruments that allow you to speculate on a stock price. If you expect the share price to rise you can take a long position, and if you think it will move lower you can go short and still make a profit on the trade if the price falls.

As a leveraged product, CFDs allow investors to maximise their gains from volatile financial assets such as stocks. However, you should be aware of the high risk involved as CFD trading also magnifies losses if the asset price moves against your position.

Once you have decided which semiconductor shares to buy, sign up for an account with Capital.com and follow our comprehensive live price charts to track the latest market developments and spot the best trading opportunities.