In recent years, with the push of smart phone manufacturers and the continuous reduction of OLED panel costs, OLED panels have now become standard for mainstream mid-range and high-end smart phones, and the penetration rate of OLED mobile phone panels has also continued to rise.

According to a survey by the market research organization Qunzhi Consulting, global smartphone OLED panel shipments surpassed LTPS (low temperature polysilicon) LCD panels in the fourth quarter of last year and the first quarter of this year. The global penetration of OLED smartphone panels is estimated in 2023. The rate will exceed 45%.

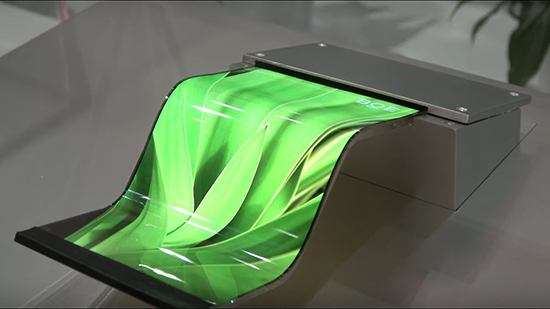

Qunzhi Consulting stated that smartphones are developing towards diversified directions such as full screens, narrow bezels, curved screens, and folding screens. OLED panels have become an important choice for complete machine manufacturers with their unique product technology, and their penetration in the smartphone market continues to increase. . The flexible OLED market will continue to grow rapidly in the future.

In addition, the OLED panel application market is also expanding. In addition to the smart phone field, the proportion of diversified markets such as smart wearables, tablet computers, notebook computers, and car displays has also been increasing in recent years.

Qunzhi Consulting predicts that the global small and medium-sized OLED panel market will reach nearly 1.2 billion in 2025, of which the shipment of OLED panels for non-smart phones is expected to be about 400 million.

In terms of the supply of small and medium-sized OLED panels, the early stage was dominated by Korean Samsung Display, and then Chinese panel makers actively followed up. With the upgrading of technology and the continuous release of production capacity in recent years, BOE, China Star Optoelectronics (CSOT), Tianma ( OLED panel manufacturers in mainland China, such as Tianma, Visionox, and EDO, have risen strongly.