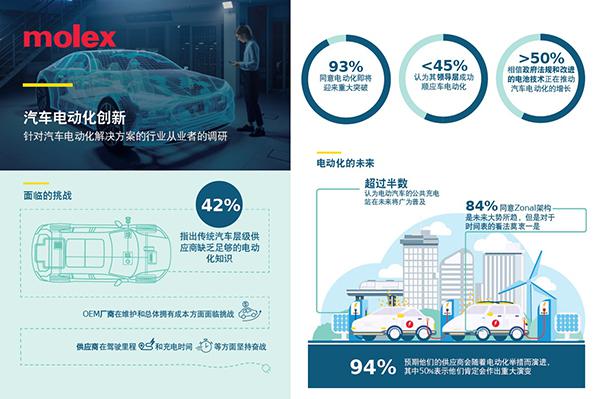

, 93% of respondents believe that electrification is about to usher in a major breakthrough

, 91% of respondents said they have difficulty in acquiring expertise in automotive electrification innovation

, Strengthening cooperation between automotive original equipment manufacturers (OEMs) and Tier 1 or Tier 2 suppliers, and increasing R&D and capital investment, will promote progress in electrification

, 84% of respondents believe that the Zonal architecture will become the standard in the future

Molex, a global electronic product leader and connectivity innovator, today announced the results of a survey of practitioners in the global automotive industry to identify major trends and obstacles affecting electric vehicle (EV) innovation. As the main driving factor to change the entire automotive architecture (including charging stations), successful electrification requires enhanced cooperation between automotive original equipment manufacturers and suppliers, increased R&D and capital investment, and design, development and delivery of power control and Breakthrough technology in battery management.

Kevin Alberts, senior vice president and general manager of the Molex Power and Signal Business Unit (PSBU), said: "The electrification of automobiles is a complex task that goes far beyond the transition from internal combustion engines to electric engines. Highly complex engineering technology and full integration ¨S manufacturing process uses ultrasonic welding, sustainable production and automation to accelerate the delivery of next-generation electrification solutions, thereby increasing the pace of innovation in all aspects of electrification."

Molex Molex commissioned Dimensional Research to conduct a survey of 204 participants on automotive electrification innovation in October 2021, including automotive companies, Tier 1 or Tier 2 suppliers and charging stations from North America, Europe, the Middle East and Africa and the Pacific. Suppliers have positions ranging from R&D, engineering, product, innovation, strategy, manufacturing to supply chain. Survey participants answered questions related to electric vehicles and in-vehicle power systems (such as power electronics, wiring harnesses, sensors, battery management systems, etc.), as well as out-of-vehicle electrification solutions (such as charging stations).

The main findings include:

, 94% of respondents believe that electrification is far more than switching to electric motors; 93% of respondents believe that electrification is about to usher in a major breakthrough

, Respondents believe that the top three growth factors include increased government support for electrification policies, improvements in battery technology, and a wider selection of electric/hybrid vehicles

, In the past two years, automobile manufacturers and their suppliers have focused on customer experience (55%), business performance (51%), leadership attention (50%), and market delivery expectations (48%). Substantial increase

, Despite the strong momentum of electrification, 92% of respondents said that their design teams have encountered difficulties in electrification; and 91% of respondents said they face challenges in acquiring much-needed expertise

Top-level functional innovation is ready to go

Respondents agreed that the innovation of electrification will bring about a wide range of improvements in car functions, including autonomous driving and driving assistance (53%), safety (43%), total cost of ownership (41%), and car charging time (39%). %) and car mileage (37%). Nevertheless, there are still challenges in improving car charging time (31%), increasing car mileage (29%), and improving autonomous driving and driver assistance (29%). Respondents also reported progress in batteries, modules or battery packs (51%), motors (47%), and powertrain electronics (45%). However, they encountered difficulties in innovations in controllers (37%), wiring harnesses, connectors and busbars (34%), cameras and sensors (33%), and powertrain electronics (26%).

Zonal architecture will become the standard

84% of respondents said that with the strong support of electronic and electrical architecture (E/E) by automakers and suppliers, the Zonal architecture will become the standard in the next five years or more. Zonal can not only reduce the network wiring harness of traditional vehicle architecture, this innovation will also greatly reduce the number of electronic controllers (ECU) in the vehicle, while significantly reducing the length, weight and cost of the wiring harness.

Cooperation is the key to the success of electrification

Survey participants faced a series of problems in acquiring the much-needed expertise to promote their innovative practices. Traditional automotive Tier 1 or Tier 2 suppliers often lack electrification expertise, while automotive OEMs are facing increasingly fierce competition from technology giants, making their internal recruitment goals even more severe. Automotive OEMs regard strengthening cooperation with suppliers as the biggest innovation driver; suppliers believe that increased investment in R&D and capital (such as tools, machinery, factories) is the most likely to promote progress in electrification.

Molex power and signal expertise

Molex's proven portfolio of innovative interconnect products and solutions is driving the development of a new generation of powertrain motor controllers, electronic controllers and battery management systems. Molex has more than 30 years of experience in serving leading automakers and suppliers in the automotive industry. It is committed to designing and providing key electronic, power, signal and connection solutions to form the central nervous system of future electric vehicles.