¡¤¡¡94% of respondents believe that digital technologies create exciting development opportunities for vehicle architecture and driving experience

In-vehicle connectivity, data storage and cloud computing have delivered the biggest gains over the past five years; V2X, 5G, AI/ML and immersive user interfaces are expected to grow significantly

¡¤ Cybersecurity, software quality and functional safety are major technical barriers

¡¤ Reducing design complexity requires expanded skills, new services and a broader ecosystem of software, consumer technology and cloud partners

Molex, a global electronics leader and connectivity innovator, today announced the results of a global survey examining the pace of innovation that is accelerating the development of next-generation vehicle architectures and driving experiences. While participants expressed optimism about the widespread adoption of digital technologies, they also noted that serious technological, industry and ecosystem challenges must be overcome to meet the demand for cars equipped with software, storage, connectivity and computing capabilities that are inherently It constitutes a powerful "data center on wheels".

Mike Bloomgren, president and senior vice president, Molex Molex Transportation and Industrial Solutions, said: "The speed of change in the entire automotive industry is set to accelerate as digital technologies enable new and more powerful capabilities for the next generation of vehicles. Our latest research Shows the need for wider collaboration across the ecosystem in order to reduce design complexity and meet consumer expectations."

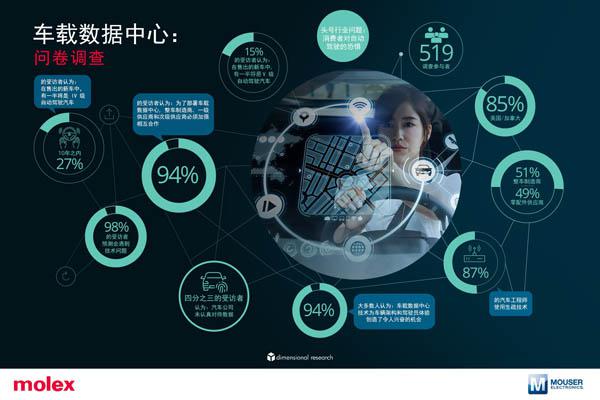

Molex and Mouser commissioned dimension Research to conduct the February 2022 "Data Centers on Wheels" automotive survey, surveying automotive companies and their suppliers, including Tier 1 or Tier 2 auto parts suppliers and contract manufacturers ) 519 eligible participants in engineering, R&D, manufacturing, innovation or strategic roles. Participants from 30 countries were asked which digital technologies will have the greatest impact on the field and the biggest barriers to the deployment of advanced vehicle architectures and the development of a seamless driving experience.

Key findings include:

94% of participants believe that digital technologies create exciting development opportunities for vehicle architecture and driving experience and require greater collaboration among industry players.

In the next five years, digital technologies will enable standard new car features, including user interfaces that can be operated via mobile apps (50%), streaming movies and TV (47%), remote enablement of new/additional features (46%), subscription model pricing for key features (46%), safety and driver assistance (45%), and over-the-air software updates (43%).

27% of participants believe that half of all new cars sold within 10 years will support Level 4 autonomy; 18% believe it will take 30 years for Level 5 autonomy to reach this level.

Connectivity will have the greatest impact

Forty-five percent of participants said in-car connectivity has had the greatest impact on vehicle architecture and driving experience over the past five years, followed by data storage systems (43 percent) and cloud computing (43 percent). Immersive UX/UI (39%) and out-of-vehicle connectivity (32%) (including 5G and V2X communications) are expected to deliver the biggest gains over the next five years. Despite the growing role of connectivity, there is no consensus on the main challenges facing connectivity, including bandwidth (32%), quality of service (28%), coverage (24%) and latency (16%).

From obstacles to improvement

Among the biggest barriers to building a "data center on wheels," participants cited cybersecurity (54%), software quality (41%), functional safety (36%), connecting vehicles to the cloud (29%), and Data storage and analysis (28%). More than two-thirds of the participants believe that software will bring more technical problems than hardware; and more than half believe that brand new services need to be provided across the entire software ecosystem, covering operating systems, artificial intelligence models, functional safety information, etc.

Participants also ranked key industry issues that could hinder the adoption of these technologies, such as consumer fears of self-driving technology (43%), insufficient investment in external vehicle charging stations and 5G antennas (37%), automotive company leadership Limited understanding of its potential (36%) and data privacy (34%). Supply chain shortages are also expected to impact next-generation vehicle deliveries, with the brunt of battery availability and chemistry (47%), semiconductor chips (45%), sensors (42%), connector cables and assemblies (40%) and connectivity device (38%).

Expand partner ecosystem

As automakers incorporate new digital technologies and capabilities into their vehicles, they will need to expand their current partner ecosystem. More than half of the survey participants will focus on consumer tech companies (such as Apple, Google, etc.), cloud providers (Amazon/AWS, Microsoft, etc.) and digital-focused vendors to help enable new automotive features. Nearly all participants agree that realizing the promise of a "data center on wheels" will require increased collaboration among OEMs, suppliers and sub-suppliers.

Molex experience extends to all areas of "data center on wheels"

Molex's invaluable experience in the data center, telecommunications, networking and consumer electronics industries has enhanced its position in the automotive industry for decades. Molex will continue to design and deliver the critical electronics, connectivity, high-speed networking, data storage, and power and signal solutions that will be the central nervous system of tomorrow's next-generation automotive architectures.